On August 22-23 at the BRICS meeting in Durban, South Africa a world historical event is taking place. There have been rumors, but the Telegram channel of "

Russia Today" has now confirmed that the new gold-backed and blockchain linked trade currency is on! On July 19 Russia announced that Foreign Minister Sergei Lavrov will replace President Putin at the Durban summit.

July 20, 2023 War Room Episode 2898: The Decline Of Reserve Currency; Unwinding The Debt Deal.

Alasdair Macleod, head of research at Goldmoney is stating in

a primer on the subject that the mainstream media in the West until today are all but ignoring the importance of the event.

And it's not just the BRICS nations -- Brazil, Russia, India, China and South Africa -- that are taking part in the venture. Participating also will be the members of the Shanghai Cooperation Organisation (SCO) (

link), and the Eurasian Economic Union (EAEU) (

link), along with whatever nations wish to join.

It will be a super-group embracing most of (Eur)Asia (including the Middle East), Africa, and Latin America. A formidable bloc and a serious challenge to the trans Atlantic hegemony.

The following tweet explains why so many nations are ready to join the project. The US can print its way out of debt (at least, according to Modern Monetary Theory), but the rest of the world must try and obtain their trading dollars by other means. And as the interlocutor explains, the system is weighted against for example, African nations.

Gold backing and blockchain linking of the currency for the inter trading currency is giving the project instant credibility. It's a major challenge for the leading fiat currencies, to wit the dollar, the euro, the British pound and the Japanese yen.

Journalists and economists have become so used to the Keynesian system, that no one knows what to make of the prospect, including Economic Nobel laureate Paul Krugman as pointed out by Dave Brat on War Room.

Capital markets are so dominated by Keynesians, automatically programmed to believe gold is bad and fiat is good, that as a stockbroker in London, when President Nixon suspended the Bretton Woods Agreement 52 years ago, Macleod recalls there was a similar level of confusion over the implications.

Reuters has a ripe example of the type of reporting in the media, out of sheer ignorance or by way of info war, who's to say?

"

A BRICS currency will not be on the agenda of the bloc's summit in South Africa next month, but Brazil, Russia, India, China and South Africa will continue to switch away from the U.S. dollar, South Africa's senior BRICS diplomat said on Thursday.

"There's never been talk of a BRICS currency, it's not on the agenda," Anil Sooklal, South Africa's Ambassador at Large: Asia and BRICS, told a media briefing. "What we have said and we continue to deepen is trading in local currencies and settlement in local currencies." (

Source)

That is correct. The BRICS are not setting up a new joint currency like the euro, but they are using the gold backed unit to settle trade in their own currencies.

A gold backed currency that rivals the petrodollar is not new. But the extraordinary sanctions against Russia that not even the Nazis had to face, acted as a catalyst.

Led by Russia, Saudi Arabia and the Gulf Cooperation Council, Asia and many other resources rich nations united in rebellion against American hegemony where politicians have abused the dollar's domination. The multi polar world is already a fact. The gold backed currency merely consolidates that reality.

Another proposal that follows from the joint trading currency will be on the table in Durban: to merge the SCO, the EAEU and BRICS into a supersized trading bloc. In terms of population and GDP it is already in excess of half the world, dwarfing the trans Atlantic alliance.

The Biden regime only last week sent Treasury Secretary Janet Yellen to Beijing. Snubbing aside, the meeting was not a great success. The mainstream media's ridiculous reports ignored that fact, with CNN fawning over Yellen's "mushroom diplomacy" (

source).

Zero Hedge has a great story on Yellen's "magic shrooms" (

source). Yellen had no other card up her sleeve than to threaten the CCP with....Western sanctions! They still haven't worked out that sanctions are a double edged sword.

Some in the West have woken up to the monetary paradigm shift. They pretend not to care, because the gold standard is "based on a fallacy". The economic theory is not new. Nathan Lewis dealt with it in an article in Forbes in 2018 (

source). But Modern Monetary Theory certainly is a fallacy, as the Keynesians are about to discover.

An advantage of the BRICS trade currency is that it will not be used for funding government deficits. It is limited to cross-border trade settlements and it does not have to appeal to public confidence. Participating countries get to keep their national currencies and it is not to be used for capital investments.

The groundwork appears to have been done by the Russian economist Sergei Glazyev, a member of the National Financial Council of the Bank of Russia. The project will hit the ground running as soon as it is approved in August.

Just two things are needed: the establishment of an issuing entity, and physical gold, allocated from the reserves of participating central banks.

In his

primer Macleod is giving a brief outline of how a new trade settlement currency based on gold can be quickly established to replace the fiat dollar in all transactions between member nations.

It is designed to be politically acceptable to all involved, as well as a long-term practical solution to facilitate the Eurasian ambitions for an industrial revolution, encompassing Africa and Latin America, free from interference by America and her allies. Not unimportant...

"All empirical evidence informs us that when gold becomes the means by which credit is valued, credit’s own value becomes tied to that of gold and is not dependent on stability in the quantity of credit. Operating as a gold substitute imparts pricing certainty to trade and investment and leads to stable, low interest rates giving the necessary conditions for maximising economic development in emerging economies."

The West itself could do with a bit of that. But that would interfere with their plans for the introductions of CBDCs by way of a major, created crisis. But then, we learnt recently from Jeftovic that CBDCs are a bit harder to implement than you'd think (

video).

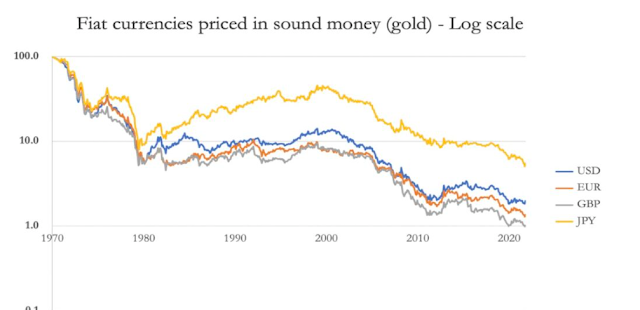

"Since the suspension of Bretton Woods, the dollar has lost 98% of its value relative to gold. The other major fiat currencies have been similarly impoverishing for their users and savers, and only now is the final act in their destruction looming due to the introduction of a new BRICS gold-backed currency."

Through the medium of gold, participating central banks will exchange their reserve dollars for the new BRICS currency. At"the suspension of Bretton Woods on 15 August 1971 the market was similarly nonplussed then as it appears to be today, with the London price on Monday 17 August at $43, slightly down on the previous week. It wasn’t until 19 November that the morning fix exceeded $43 again for the first time. It took two whole months for the implications to sink in. But when they did, the price rose to $197.50 on 27 December 1974."

Gold is poorly understood in financial markets. For the last forty years traders have lost sight of gold being money, seeing it is a trading counter that plays on irrational fears of instability of the modern currency system. With the return of gold as the anchor for credit for Eurasia and its trading partners, those fears will suddenly become real.

Comments

Post a Comment